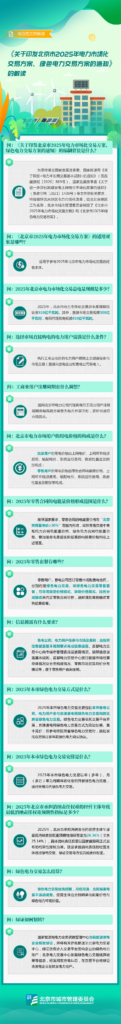

On December 12, 2024, the Beijing Municipal Commission of Urban Management issued the Beijing 2025 Electricity Market-based Trading Program and the Beijing 2025 Green Power Trading Program (hereinafter referred to as the Electricity Market-based Trading Program and the Green Power Trading Program).

According to the Beijing power market-oriented trading program, in 2025, the total power market-oriented trading scale in Beijing is proposed to arrange 91 billion kilowatt-hours, of which, the direct market trading scale of 30 billion kilowatt-hours, the grid agent power purchase scale of 61 billion kilowatt-hours. From the division of time, the 2025 Beijing power market-oriented trading is divided into the following five time periods: 1. peak time: daily 10:00-13:00; 17:00-22:00; 2. flat section: daily 7:00-10:00; 13:00-17:00; 22:00-23:00; 3. valley time: daily 23:00-7:00 the next day; 4. Summer peak hours: 11:00-13:00 and 16:00-17:00 per day in July-August; 5. Winter peak hours: 18:00-21:00 per day in January and December. The price of electricity for retail users consists of the retail contracted energy price, feed-in tariffs, line loss charges, transmission and distribution tariffs, system operation costs, government funds and surcharges.

Beijing 2025 green power trading program stipulates that in 2025, the city's green power trading mainly includes the city's power sales companies, power users to participate in the Beijing-Tianjin-Tangshan power grid green power trading and inter-regional and inter-provincial green power trading. Green power transactions relying on trading platforms, Beijing-Tianjin-Tangshan power grid green power transactions for bilateral negotiation, centralized bidding; participation in inter-area and inter-provincial green power transactions, encouraging the generation and use of both sides to sign a multi-year green power purchase agreement. Green power trading price formed by the market-oriented mechanism, should fully reflect the price of electricity and green power environmental value. The price of electricity consumed by users consists of the green power trading price, line loss costs of the feed-in link, transmission and distribution prices, system operation costs, government funds and surcharges. The environmental value of green power can refer to the average price of the last settlement cycle (natural month) in the Affordable Green Certificate Market of the State Grid operation area. The cost of line loss in the online link is implemented in accordance with the price of electricity energy based on the relevant policy rules, and the transmission and distribution tariffs, system operation costs, governmental funds and surcharges are implemented in accordance with the relevant regulations of the State and Beijing. Users implementing the peak and valley time-sharing electricity price policy will continue to implement the peak and valley time-sharing electricity price policy. In principle, the environmental value of green power is not included in the calculation of the peak-valley time-sharing tariff mechanism and the power transfer fee, etc., in accordance with the relevant national and Beijing policy rules.

Here are the details:

Beijing Power Trading Center, State Grid North China Division, State Grid Beijing Electric Power Company, Capital Power Trading Center, all relevant market players:

The Beijing Municipal Electricity Market-based Trading Program for 2025 and the Beijing Municipal Green Electricity Trading Program for 2025 are hereby issued to you for your compliance. The Circular on the Issuance of Beijing Municipality's 2024 Electricity Market-based Trading Program and Green Electricity Trading Program (Jing Guan Fa [2023] No. 16) shall be repealed from January 1, 2025 onwards.

Notice is hereby given.

Beijing Municipal Commission of Urban Management

December 12, 2024

Beijing 2025Electricity market-based tradingprogrammatic

In order to implement the requirements of the National Development and Reform Commission and the National Energy Administration's "Notice on the Issuance of " (NDRC Energy Regulation [2020] No. 889), the National Development and Reform Commission's "Notice on Further Deepening the Reform of Feed-in Tariffs for Coal-Fired Power Generation on a Market-Based Basis" (NDRC Price [2021] No. 1439) and other documents, and to continue to do a good job of reforming the marketization of electric power in the Beijing area. Give full play to the role of ballast stone and stabilizer of medium and long-term electricity trading, and steadily push forward the work of Beijing's 2025 electricity market-oriented direct trading, combined with the actual situation in Beijing, this program is hereby formulated.

I. Scale of traded electricity

In 2025, it is proposed to arrange 91 billion kilowatt-hours of total power marketized trading scale in Beijing, of which 30 billion kilowatt-hours will be traded in the direct market and 61 billion kilowatt-hours will be purchased by the power grid agent.

II. Market participation modalities

(i) Direct participation in market transactions

In principle, all power users implementing industrial and commercial tariffs are directly involved in market transactions (directly purchasing power from power generation enterprises and power-selling companies, hereinafter the same).

Electricity users choosing to participate directly in market transactions shall complete market registration at the Capital Electricity Trading Center. Electricity users may apply for market entry by the name of the unit on the electricity supply and use contract, or by the name of the unit of the bill payer (authorization from the unit on the electricity supply and use contract is required, which is deemed to be the same as the unit on the electricity supply and use contract entering the market). All of its electricity shall be purchased through direct participation in market transactions. Users whose annual electricity consumption exceeds 5 million kilowatt-hours are encouraged to carry out direct trading of electricity with power generation enterprises.

(ii) Purchase of electricity by grid agents

For power users who are not directly involved in market transactions for the time being, the power purchase will be made by the agent of State Grid Beijing Electric Power Company; for power users who have been directly involved in market transactions and have withdrawn from them, the power purchase will be made by the agent of State Grid Beijing Electric Power Company on the basis of user number, and the price of their electricity will be implemented in accordance with the relevant national policy documents.

Industrial and commercial users who are represented by State Grid Beijing Electric Power Company in purchasing electricity may complete the registration in the Capital Electric Power Trading Platform before the 15th day of each month, and choose to participate in the market transaction directly from the next month onwards, and the representation of State Grid Beijing Electric Power Company in purchasing electricity shall be terminated accordingly. The Capital Power Trading Center shall inform State Grid Beijing Electric Power Company of the above change within 2 days.

III. Organization of the transaction

The market-based trading of electricity in Beijing is jointly organized by the Beijing Electricity Trading Center and the Capital Electricity Trading Center.

(i) Market members

1. Power Generation Enterprises

Power generation enterprises that meet the relevant requirements of the Notice on the Issuance of the Medium- and Long-Term Trading Rules for Electricity of the Beijing-Tianjin-Tangshan Power Grid (North China Supervision and Energy Market [2020] No. 221) of the North China Energy Regulatory Bureau, subject to the announcement of the Power Trading Center.

2. Power sales companies

Electricity sales companies registered and validated on the Capital Electricity Trading Platform.

3. Electricity users

Electricity users whose registrations are effective on the Capital Electricity Trading Platform are categorized into wholesale and retail users, and participate in the wholesale and retail markets, respectively, according to the type of registration.

4. Electricity market operators

Including Beijing Power Trading Center Market Trading Department 2 and Capital Power Trading Center; North China Power Dispatching and Control Center and Beijing Power Dispatching and Control Center.

(ii) Specific modalities for the organization of transactions

1. Transaction method

(1) In order to implement the national electric power market-oriented reform work deployment, in 2025, the Beijing Municipality used bilateral negotiation, centralized trading and other methods to carry out time-shared medium- and long-term trading of electric power. The trading cycle includes annual, monthly and intra-monthly. Annual transactions are declared on a monthly basis, with bilateral negotiation as the main method, and monthly and intra-monthly transactions are based on centralized bidding. The specific content is executed in accordance with the trading announcement issued by the Power Trading Center. Grid enterprises' proxy power purchase transactions are carried out in accordance with the provisions of the relevant documents of the State and Beijing Municipality.

(2) Contracts arising from contractual power transfer transactions are limited to the settlement of user-side wholesale market transactions, and the price of electricity used by users in the Beijing regional electricity market does not include the price of contractual power transfer transactions in the price of electricity energy transactions. The settlement of contracted power transfer transactions is made on a monthly basis.

2. Trading unit

Electricity Users: Uniformly packaged electricity consumption units of all voltage levels of the same registered user to participate in the transaction.

Electricity sales companies: Uniformly packaged electricity consumption units of all voltage levels of the customers they represent to participate in the transaction.

State Grid Beijing Electric Power Company: The user numbers of all voltage levels of the represented users are uniformly packaged to participate in the transaction.

3. Safety calibration

The Power Dispatch Control Center of the North China Division of the State Grid coordinates with the relevant power dispatching agencies to carry out the security calibration of direct transactions.

4. Publication of transaction results

Transaction results are released by the Beijing Power Trading Center and the Capital Power Trading Center. Once the trading results are released by the power trading platform, they will be used as the basis for trading execution, and the trading parties will no longer sign paper contracts.

IV. Direct transaction prices

Coal-fired power generation market trading price in the "benchmark price + up and down fluctuations" within the scope of the formation of the benchmark price applicable to the landing province benchmark price level, fluctuation range in principle do not exceed 20%. encourage the purchase and sale of the two sides in the medium- and long-term contract to set up a trading price of electricity with the changes in the cost of fuel reasonable fluctuations in terms of the implementation of the trading price and the coal price linkage Linkage to ensure stable energy supply.

(i) Segmentation of time periods

The 2025 Beijing Electricity Market-based Trading is divided into the following five time periods:

1. Peak hours: 10:00-13:00; 17:00-22:00 daily;

2. Flat section: 7:00-10:00; 13:00-17:00; 22:00-23:00 daily;

3. Low hours: 23:00 - 7:00 the next day;

4. Summer peak hours: 11:00-13:00 and 16:00-17:00 daily in July-August;

5. Winter peak hours: 18:00-21:00 daily in January and December.

(ii) Transaction price

The electricity price for wholesale users consists of the feed-in tariff, the cost of line losses in the feed-in chain, the transmission and distribution tariff, the system operating costs, government funds and surcharges; the electricity price for retail users consists of the retail contracted energy price, the cost of line losses in the feed-in chain, the transmission and distribution tariff, the system operating costs, government funds and surcharges, and so on. Among them:

The feed-in tariffs are formed by market-based transactions, and the retail contractual electricity energy prices are agreed upon by the electricity selling companies and retail users signing retail packages. The cost of line loss and system operation in the feed-in link will be accounted for and publicized by the grid enterprises in accordance with the requirements of the State and Beijing Municipality, and will be apportioned or shared by all industrial and commercial users on a monthly basis.

Transmission and distribution tariffs include regional grid transmission and distribution tariffs and Beijing grid transmission and distribution tariffs. Regional grid transmission and distribution tariffs are implemented in accordance with the National Development and Reform Commission's Circular on Regional Grid Transmission and Distribution Prices and Related Matters for the Third Supervisory Cycle (NDRC [2023] No. 532). The transmission and distribution tariffs for the Beijing Power Grid are implemented in accordance with the National Development and Reform Commission's Circular on the Transmission and Distribution Tariffs for Provincial Power Grids in the Third Supervisory Cycle and Related Matters (NDRC [2023] No. 526) and the Municipal Development and Reform Commission's Circular on the Transmission and Distribution Tariffs for the Third Supervisory Cycle of the Beijing Power Grid and Other Related Matters (Beijing Development and Reform [2023] No. 637).

(iii) Time-of-day tariffs

Power generation enterprises directly report the total amount to participate in the transaction, and the transaction price is implemented as a single offer, with the same price for each time period of the peak, peak, flat and valley segments. Wholesale users and power-selling companies adopt the mode of reporting volume and single offer in time slots, reporting volume according to the peak, peak, flat and valley segments, and participating in the transaction with the total volume.

Users implementing the peak and valley time-sharing tariff policy continue to implement the peak and valley time-sharing tariff policy. Specifically in accordance with the Municipal Development and Reform Commission's Notice on Further Improving the City's Time-Sharing Electricity Pricing Mechanism and Other Related Matters (Beijing Development and Reform Regulation [2023] No. 11). In case of adjustment of the tariff policy, it will be implemented according to the new policy.

The feed-in tariffs (including regional power grid transmission and distribution costs and network loss discounts) formed by wholesale users through market-based transactions are used as the flat segment price, which is the benchmark for participating in the peak-valley fluctuation; retail users use the retail contracted power energy price as the flat segment price, which is the benchmark for participating in the peak-valley fluctuation. The line loss cost of the Internet link, transmission and distribution price of the Beijing Power Grid, system operation cost and governmental funds and surcharges are not subject to the peak-valley time-sharing tariff. In case of adjustment of tariff policy, the tariff will be implemented in accordance with the new policy.

V. Settlement modalities

In 2025, the settlement mode of power market-oriented trading in Beijing will be implemented in accordance with the current policy documents of the North China Energy Regulatory Bureau (NCERB). The deviation of power generated by power purchase by grid enterprises' agents will be implemented in accordance with the relevant documents of the State and Beijing Municipality. In case of policy adjustment, it will be implemented in accordance with the new policy.

(i) Deviation settlement

The difference between the actual power consumption of wholesale users and power sales companies and the total power consumption of various types of trading contracts (purchase and sale contracts) is the deviation power, and the ratio of the deviation power to the total power consumption of various types of trading contracts (purchase and sale contracts) is the deviation rate, i.e., K. U1 and U2 are the adjustment coefficients.

The 2025 deviation settlement is implemented in a stepped manner as follows:

When K∈[-5%,5%],U1=1,U2=1;

When K∈[-15%,-5%)∪(5%,15%],U1=1.1,U2=0.9; the

When K ∈ [-40%,-15%) ∪ (15%,40%], U1 = 1.15, U2 = 0.85; the

When K∈[-100%,-40%)∪(40%,+∞),U1=1.2,U2=0.8.

The adjustment coefficients will be adjusted in due course according to the operation of the Beijing market at a later stage and released to the operating entities. The deviation power generated by the power purchase by the grid enterprise agent will be settled in accordance with the monthly bidding clearing price of the Beijing-Tianjin-Tangshan Power Grid.

(ii) Deviation funding

In 2025, the deviation funds arising from the settlement of contractual deviation of electricity by wholesale users and power sales companies will be apportioned in principle within the scope of wholesale users and power sales companies in the Beijing region. The specific principles of apportionment are as follows:

1. Principle of apportionment of funds

Taking into account the two dimensions of the deviation power volume and deviation rate, the funds for the deviation settlement difference are apportioned in accordance with the principle of "whoever generates, whoever apportions, and encouraging deviation control". The total amount of the deviation settlement difference funds and the amount to be shared by each operating entity for each month are calculated in accordance with the settlement data of that month and settled on a monthly basis.

2. Specific calculations

(1) Total funds for deviation settlement differences

The total amount of funds for deviation settlement difference refers to the difference between the sum of the electricity energy contract fees and deviation settlement fees expended by the wholesale users and the electricity sales companies and the sum of the direct transaction electricity energy contract fees and deviation settlement fees paid by Beijing Grid to the North China Grid in the same month.

The total amount of funds for deviation settlement differences for each month is calculated as follows:

M = M users - M grid;

M is the total amount of deviation settlement difference funds for the month;

M users are the sum of the electric energy contract costs and deviation settlement costs expended by wholesale users and power sales companies during the month;

M Grid is the sum of the contractual fees and deviation settlement fees paid by Beijing Grid to North China Grid for directly traded electricity energy.

(2) Basis of assessment

In accordance with the principle of fund apportionment, the base figure for fund apportionment of deviation settlement difference is set according to the deviation power quantity and deviation rate of the operating entities as the calculation condition for the amount of fund apportioned to each operating entity, which is calculated as follows:

Fi = Qi x (1-Xi)2 when the total monthly differential funding is positive;

Fi = Qi x Xi2 when the total monthly differential funding is negative;

Fi is the deviation settlement difference funding apportionment base for the month for the ith wholesale trading user;

Qi is the absolute value of the deviation power of the ith wholesale trading user for the month;

Xi is the absolute value of the deviation rate of the ith wholesale trading user in the month, i.e., the absolute value of the ratio of the deviation of the ith wholesale trading user in the month to the contracted power, and the contracted power includes the sum of the annual sub-monthly, monthly, contracted power transfer and green power and other types of wholesale market contracts, and Xi is greater than or equal to 1 and the contracted power is 0. Xi is the maximum value of the deviation rate of the wholesale trading user with other deviation rates of less than 1 in the month. Xi takes the maximum value of the deviation rate of other wholesale trading users with deviation rate less than 1 in that month.

(3) Apportioned funds

Each operating entity's share of the deviation settlement margin funds is equal to the total deviation settlement margin funds apportioned for the month multiplied by the proportion of its apportionment base to the sum of the apportionment bases of all the operating entities, calculated as follows:

Mi = M x Fi/F;

Mi is the deviation settlement difference fund apportioned to the ith wholesale trading user for the month;

M is the total amount of funds apportioned for deviation settlement differences for the month;

F is the sum of the deviation settlement difference funding apportionment base for all wholesale trading users for the month.

Subsequent adjustments to the calculation methodology will be made in due course in accordance with market performance.

When the operating entity occurs the electricity charge recovery and refund compensation, no longer restore and allocate the historical difference funds, and include the total difference funds in the recovery month for uniform distribution.

(iii) Exemption from liability for deviations

The deviation exemption application and handling process is based on the Municipal Urban Management Commission's Notice on the Work Related to the Exemption of Beijing Electricity Medium- and Long-Term Transactions for Deviated Electricity Quantity (Jing Guan Fa [2023] No. 2). In case of policy adjustment, the application will be executed in accordance with the new policy.

VI. Retail transactions

(i) Retail agents

1. The retail user binds an agency relationship with the electricity selling company, signs a retail package, and the electricity must be distributed through the agency of the electricity selling company (consistent with the agency relationship for green power trading), and the agency relationship between the two parties is based on the retail package in effect on the electricity trading platform. The minimum period for retail customers to change their agency relationship is monthly.

2. In the event that the state introduces preferential policies on electricity prices during the contract period, and when specific industries are included in the management of non-residential users implementing residential prices, eligible retail users may choose to withdraw from the market without implementing the penalty tariff for unjustified withdrawal, and the corresponding deviation of electricity generated is included in the scope of the exemption from liability for deviation.

(ii) Retail prices

1. The price of electricity energy of the retail contract is formed within the range of "Beijing Coal Benchmark Price ± 20%", and the price of electricity energy settled between the retail customer and the electricity selling company does not include the coal power capacity tariff.

2. In the event of national tariff policy adjustments affecting retail transactions during the contract period, the electricity sales company and the retail user shall implement the national requirements by signing a supplementary agreement or adding binding clauses in the contract.

(iii) Retail packages

1. Retail users and power sales companies sign retail market power purchase and sale contracts, agreeing on green power trading and non-green power trading retail packages, respectively, and may adopt fixed price model, linked price model, and proportional share model to agree on the retail contract price, and add other models of retail settlement packages in due course.

2. Green electricity retail packages shall specify the price of electricity energy and the environmental value of green electricity respectively. The environmental value of green power of retail users shall be settled according to the environmental value of green power in the corresponding green power wholesale contract. Both parties may agree on the compensation terms for the environmental value of green power as needed.

3. In order to protect against market risks and safeguard the interests of both buyers and sellers, retail users and electricity selling companies are encouraged to agree on the upper and lower limits of retail prices.

4. The electricity sales company settles the retail revenue based on the actual electricity consumption of the retail customers, and calculates the retail revenue in the way of levelized tariff. The revenue of the electricity sales company is the revenue of the electricity sales company in the retail market minus the expenditure in the wholesale market, and the revenue of the electricity sales company includes the revenue of the electricity sales service, and the electricity sales service fee is no longer listed separately.

(iv) Deviation settlement

1. The electricity sales company and the retail customer may negotiate the proportion of deviation sharing. The total amount of deviation co-payment for retail users shall not exceed the excess power purchase cost of the deviated power in the wholesale market of the electricity sales company. The deviation co-payment of the retail customer is calculated by discounting the absolute value of the customer's deviation into the price of electricity in the retail contract.

2. Retail customers and power sales companies can negotiate monthly adjustments to the retail contract power and settlement key parameters.

VII. Disclosure of information

(i) Encourage power sales companies to publish on the electricity trading platform the standard packages that can be contracted and the amount of electricity that can be contracted, with each power sales company publishing no fewer than one type of package.

(b) Before participating in market transactions, power sales companies and power users shall complete information disclosure in accordance with the requirements of the basic rules on information disclosure. The Capital Electricity Trading Center reports the disclosure to the Municipal Urban Management Commission.

(c) In accordance with the basic rules of information disclosure, the Capital Electricity Trading Center discloses on a monthly basis the overall situation of market settlement and the composition of the classification, and the distribution of the average price of retail market settlement, etc., so as to facilitate the use of retail users' inquiries.

(d) When the results of market transaction clearing are publicized to the operating entities, if the operating entities fail to confirm the results in time due to the publicity period being a holiday, the electricity tariffs for the erroneous amount of electricity will be revised by way of refunding and compensating.

VIII. Related work requirements

(i) Electricity consumers may establish a retail service relationship with only one electricity sales company in the same contract cycle. The electricity selling company cannot represent the generating company in the transaction.

(ii) Market-based electricity users (including power sales companies, power grid agents to purchase electricity) 2025 medium- and long-term contract signed power should be no less than 80% of the previous year's electricity consumption, and through subsequent contracts, to ensure that the proportion of electricity contracted for medium- and long-term contracts of electricity is no less than 90%. business entities are encouraged to enter into medium- and long-term contracts of electricity with a maturity of more than one year.

(c) High-energy-consuming enterprises participating in Beijing's electricity market-oriented trading shall be executed in accordance with the relevant national policy documents.

(d) Renewable energy power consumption in accordance with the Municipal Development and Reform Commission, the Municipal Urban Management Commission "on the issuance of the Beijing renewable energy power consumption guarantee work program (trial) notice" (Beijing Development and Reform 〔2021〕 No. 1524) related to the implementation of the relevant requirements. 2025, Beijing City, bear the responsibility for the consumption of the operating body of the annual minimum weight of the responsibility for consumption of the expected indicators tentatively set at 26.361 TP3T ( Non-water 25.14%), and the specific weight of consumption responsibility shall be subject to the binding index officially issued by the National Energy Administration. Operators with consumption responsibility are encouraged to fulfill their responsibility through green power trading and green certificate trading.

(e) Power sales companies that have completed market registration may participate in market transactions only after submitting a performance bond or performance insurance that meets the requirements within a specified period of time. The issuance, management and implementation of the performance bond or performance insurance shall be in accordance with the "Guidelines for the Management of Performance Guarantee Certificates in the Beijing Electricity Market (for Trial Implementation)".

(vi) The power purchase and sale contract for the Beijing electricity retail market (2025 model text) and the settlement guidelines for market-based direct transactions in Beijing (2025) will be issued separately by the Capital Electricity Trading Center.

(vii) In accordance with the relevant requirements of the State, it is strictly prohibited to add other charges in the collection of electricity. The operation and maintenance costs of the public parts of the property, common facilities and ancillary facilities shall be resolved through property fees, rents or public revenues, and it is strictly prohibited to add service-type charges based on electricity tariffs.

(viii) power users due to metering device failure and other reasons for power errors, occurring in the current year's billing period of the amount of electricity, in accordance with the transaction contract, retail packages and other parameters of the calculation of the relevant business entity to refund the electricity bill, involving deviations in the adjustment of the shared costs in the occurrence of the refund of the business entity between the liquidation. The electricity volume occurring in the calendar year's account period will be calculated in accordance with the settlement price of the electricity energy traded in the corresponding month of the power user, and the relevant costs of the power sales company will no longer be retrospective.

(ix) Establishment of a risk warning mechanism for retail packages, the Capital Electricity Trading Center should do a good job of market monitoring, and when the price of electricity retail packages exceeds the average expected level in the market, the relevant business entities will carry out risk alerts and report to the Municipal Urban Management Commission in a timely manner.

(J) Beijing Power Trading Center, the capital power trading center to do a good job in Beijing power market transaction organization, to further improve the quality of service, optimize the settlement, clearing and other work processes, and actively carry out training activities for members of the market, to strengthen the transaction information monthly report system, and in accordance with the relevant rules and timely disclosure of information to the community as well as the main body of the operation. If there is any default behavior of the operating entities, it will be recorded in a timely manner and reported to the Municipal Urban Management Commission on a regular basis.

(xi) The relevant transaction subjects, in the transaction process, strictly abide by laws and regulations and relevant rules. Shall not collude in the offer, inflate prices, disrupt the market order, can not abuse the dominant market position to manipulate the market price, with the power company's power generation companies, shall not take advantage of the "offer as one" advantage of direct or disguised way to reduce the cost of power purchase of the company's power sales to seize market share, shall not be on the private power companies and other types of power sales and large users of electricity. No differentiation shall be made between various types of electricity sales entities such as private electricity sales companies and large electricity users. Power generation enterprises with multiple power plants shall not centralize their offers when conducting electricity energy transactions. Specific transactions shall not be realized between relevant business entities on the power generation side and the power sales side through online and offline means by uniformly agreeing on the transaction price, power quantity and other declared elements outside the medium- and long-term bilateral negotiated transactions. If the normal development of the transaction is affected by violation of the relevant rules and disruption of market order, the relevant units and business entities shall be investigated for their responsibilities in accordance with the law.

(XII) Beijing 2025 electricity market-oriented trading in accordance with the implementation of this program, in the event of policy adjustments, by the Municipal Urban Management Commission issued separately.

Beijing Green Power Trading Program 2025

In order to implement the strategic deployment of carbon peak, carbon neutral, accelerate the establishment of a market system and long-term mechanism conducive to the promotion of green energy production and consumption, and promote the orderly development of green power trading in the city, in accordance with the General Office of the National Development and Reform Commission, the Comprehensive Department of the National Energy Administration, "on the orderly promotion of the green power trading of the notice on matters related to the" (Development and Reform Office of the body of reform 〔2022〕 No. 821), North China Energy Regulatory Bureau, "the Notice on ImprovingGreen Power TradingMechanism to promote the Beijing-Tianjin-Tangshan grid affordable new energy projects into the market notice" (North China Supervisory Energy Market [2023] No. 46), as well as the National Development and Reform Commission, the National Energy Board, "on the issuance of" the basic rules of medium- and long-term trading of electric power - green power trading special chapter "notice" (Development and Reform Energy [2024] No. 1123) and other documents, has formulated this program.

I. Definition of green power trading

Green power trading refers to the green power and the corresponding green power environmental value as the underlying power trading varieties, trading power at the same time to provide state-issued renewable energy green power certificates (hereinafter referred to as green certificates) to meet the demand for power generation enterprises, power companies selling power users, such as the sale and purchase of green power. Initially, to participate in the green power trading of the power generation side of the main wind power, photovoltaic power generation projects, when conditions are ripe, can be gradually expanded to meet the conditions of other renewable energy. Power sales companies, power users can purchase green power through the green power trading platform (hereinafter referred to as the trading platform).

II. Business entities

The business entities participating in the City's green power trading include: power sales companies and power users.

Power sales companies and power users (including wholesale and retail users) are required to register on the trading platform. Wholesale users directly trade with power generation companies to purchase green power products, and retail users purchase green power products through the agency of power sales companies. Retail users sign a market-based power purchase and sale contract settlement confirmation agreement with the power sales company and submit it to the Capital Power Trading Center, and then the power sales company acts as an agent to participate in green power transactions and maintains the same agency relationship with the power sales company for other market power quantities.

Relevant business entities participate in green power trading according to their own actual needs and on the premise of being fully aware of the risks of trading in the green power market, adhering to the principle of truthfulness and voluntariness.

III. Transaction modalities

In 2025, the city's green power trading mainly includes the participation of the city's power sales companies and power users in the Beijing-Tianjin-Tangshan power grid green power trading and cross-region and cross-provincial green power trading. Green power transactions relying on trading platforms, Beijing-Tianjin-Tangshan power grid green power transactions for bilateral negotiation, centralized bidding; participation in inter-area and inter-provincial green power transactions, encouraging the generation and use of both sides to sign a multi-year green power purchase agreement.

IV. Trading arrangements

(i) Transaction cycle

Beijing Power Trading Center, together with the Capital Power Trading Center, organizes and carries out green power trading on a regular basis in accordance with the demand of the operating entities and the trading intention of wind power and photovoltaic power generation enterprises, and carries out green power trading within the month in due course, taking the cycle of year (multi-year) and month (multi-month) as a normative one.

(ii) Transaction reporting

The operating entity adopts the mode of declaring the amount of electricity by time slots and making a single offer, and participates in the transaction with the total amount of electricity for each time slot. When an operating entity declares that it will participate in the transaction with the total amount of electricity for the whole time period, the amount of electricity for each month shall not exceed its actual maximum usable electricity capacity for the month.

(iii) Transaction price

The green power trading price is formed by a market-based mechanism and should fully reflect the price of electricity and the environmental value of green power. The price of electricity consumed by users consists of the green power trading price, the line loss cost of the feed-in link, the transmission and distribution price, the system operation cost, and governmental funds and surcharges. The environmental value of green power can refer to the average price of the last settlement cycle (natural month) in the Affordable Green Certificate Market of the State Grid operation area. The cost of line loss in the online link is implemented in accordance with the price of electricity energy based on the relevant policy rules, and the transmission and distribution tariffs, system operation costs, governmental funds and surcharges are implemented in accordance with the relevant regulations of the State and Beijing. Users implementing the peak and valley time-sharing electricity price policy will continue to implement the peak and valley time-sharing electricity price policy. In principle, the environmental value of green power is not included in the calculation of the peak-valley time-sharing tariff mechanism and the power transfer fee, etc., in accordance with the relevant national and Beijing policy rules.

V. Organization of the transaction

Beijing's green power trading is jointly organized by the Beijing Power Trading Center and the Capital Power Trading Center.

(i) Organizational process of green power trading for the Beijing-Tianjin-Tangshan Power Grid

1. Declaration of Requirements

Beijing Power Trading Center, in conjunction with the Capital Power Trading Center, issues transaction announcements on the trading platform. The operating entity declares and confirms the amount of electricity (power), tariff and other information in accordance with the time requirements, and the trading platform is cleared to form an unconstrained trading result.

2. Safety calibration

Beijing Power Trading Center submits the results of unconstrained transactions to the relevant scheduling agencies for security calibration, and releases the results of constrained transactions after security calibration.

(ii) Organizational process of inter-regional and inter-provincial green power trading

Cross-regional and cross-provincial green power trading is organized and implemented in accordance with the relevant national sectoral rules and documents.

VI. Settlement of transactions

Green power transactions are settled on a priority basis, with monthly settlements and no rolling adjustments for contractual deviations. The operating entities shall specify the price of electricity energy and the environmental value of green power respectively. Among them, the settlement method of electric energy price is in accordance with the current policy documents of North China Energy Regulatory Bureau, and the adjustment coefficient refers to the implementation of the "Beijing 2025 Electricity Market-based Trading Program"; the environmental value of green power is settled according to the principle of taking the lesser of the contracted power, the power generation company's on-grid power, and the power users' power consumption of the month to determine the amount to be settled (rounded up to the nearest whole number in terms of megawatt-hours, with tailing differences rolled over into the next month for accounting purposes). Among them, if the same power user/power sales company contracts with multiple power generating enterprises and the total power consumption is lower than the total contracted power, the power consumption of the power user/power sales company corresponding to each power generating enterprise will be adjusted downward proportionally in accordance with the proportion of the total power consumption in the total contracted power; if the same power generating enterprise contracts with multiple power users/power sales companies, and the total amount of on-grid power is lower than the total contracted power, the amount of on-grid power of the power generating enterprise corresponding to each power user/power sales company will be adjusted downward proportionally in accordance with the proportion of the total on-grid power. If the total on-grid power consumption of the same power generation enterprise is lower than the total contracted power consumption, the on-grid power consumption of the power generation enterprise corresponding to each power user/power sales company shall be reduced in proportion to the proportion of the total on-grid power consumption to the total contracted power consumption.

Electricity users participating in green power trading are given a reward of 0.02 yuan per kWh according to the amount of electricity settled in green power trading.

VII. Transfer of green certificates

The Power Business Qualification Management Center of the National Energy Administration issues green certificates for new energy power generation enterprises and pushes the relevant information to the Beijing Power Trading Center, and the green certificate information is credited to the green power account of the power generation enterprises on the trading platform; the Beijing Power Trading Center transfers the green certificates from the power generation enterprises to the power users on the trading platform based on the settlement results of the green power transactions and other information, which are confirmed by both the power generation enterprises and the power users.

VIII. Related work requirements

(a) The green certificate is the only proof of the environmental attributes of renewable energy power in China, and is the only voucher that recognizes the production and consumption of renewable energy power.

(ii) Encouraging power users to actively participate in green power trading, increasing the proportion of renewable energy consumption, and implementing priority organization, priority dispatching and priority settlement requirements in all aspects of green power trading.

(c) Encourage transnational corporations and their industrial chain enterprises, export-oriented enterprises and leading enterprises in the industry to purchase green certificates and use green power products, and play a demonstration-led role. Support foreign-invested enterprises to participate in green certificate trading and green power trading. Promote central enterprises, local state-owned enterprises, authorities and institutions to play a leading role in steadily increasing the proportion of green power products consumed. Strengthen the green power consumption responsibility of high energy-consuming enterprises, and upgrade the level of green power consumption as required. Support key enterprises and parks to consume a high proportion of green power and create green power enterprises, green power parks and green power units. Supporting urban sub-centers to carry out green power and green certificate trading to help high-quality development.

(d) Before the announcement of the transaction is released, it shall be submitted to the Municipal Urban Management Commission. Beijing Electric Power Trading Center and Capital Power Trading Center shall promptly organize training on the operation of the trading platform and policy dissemination for business entities interested in participating in green power trading.

(e) Beijing Green Power Trading 2025 will be implemented in accordance with this program, and in case of policy adjustment, it will be issued separately by the Municipal Urban Management Commission.

Document Illustration - Interpretation of the Notice of the Beijing Municipal Commission of Urban Management on the Issuance of the Beijing Municipal Electricity Market-based Trading Program and Green Electricity Trading Program for 2025

Special notice: Goodhao is reproduced from other websites for the purpose of transmitting more information rather than for profit, and at the same time does not mean to endorse its views or confirm its description, the content is for reference only. Copyright belongs to the original author, if there is infringement, please contact us to delete.