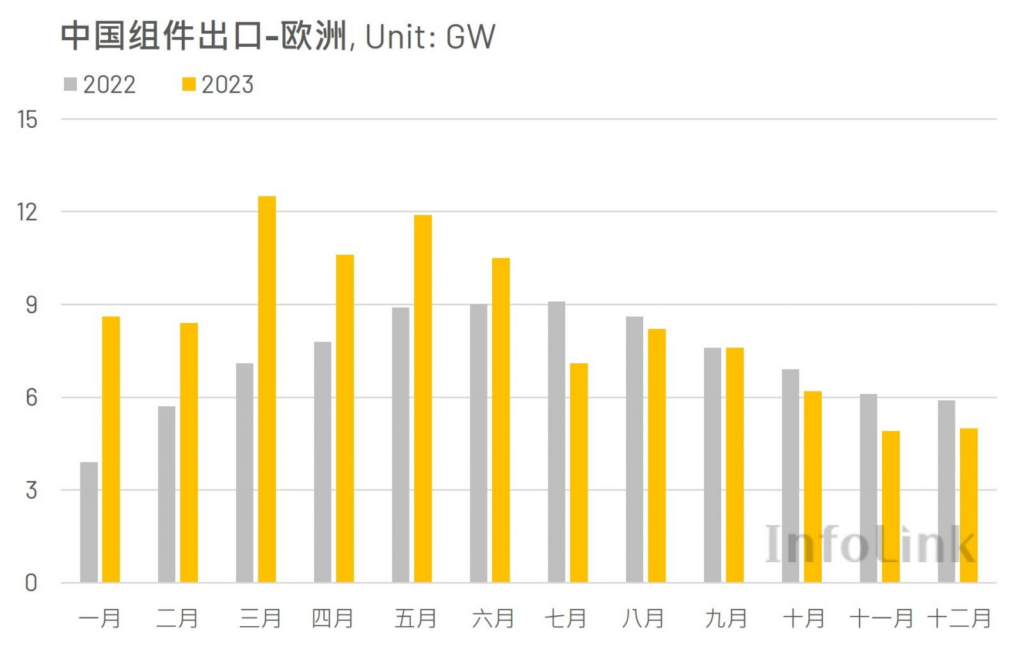

At the beginning of 2023, European countries gradually regarded the development of renewable energy as part of their regional security strategy, with photovoltaic (PV) being the most prominent. However, due to the first half of last year, the market was overly optimistic about the annual demand for PV and shipped a large number of products, resulting in the second half of last year began to appear the problem of the accumulation of module inventory, the spot price of modules also fell from $0.238 per watt in January 2023 to $0.13 per watt in December, a drop of nearly 45%, reflecting the overall PV market oversupply situation.

Market Overview and Policy Observations of Major European Countries

Europe is the second largest PV market in the world after China. The demand for PV modules will be 89 GW in 2023, and is expected to increase to 97-115 GW this year, with an overall growth rate of around 20%. Germany, Spain, Poland and Italy are the top four PV markets in Europe. InfoLink forecasts that this year's demand for PV modules in these four countries will be 17.5-19.5 GW in Germany, 11.5-12.5 GW in Spain, 7.5-8.5 GW in Poland, and 5-6.2 GW in Italy, which will account for a total of 42% of the European market demand. Therefore, the following observations will be made with respect to the installed capacity of the above four countries, the demand for PV modules this year, and the development of policies.

German

According to the German Federal Network Agency (Bundesnetzagentur), 14.26 GW of new PV installations will be added in 2023, exceeding the annual installation target, with the increase mainly coming from rooftop and balcony PV, reflecting the effectiveness of Germany's stimulus policy in boosting demand. By the end of 2023, Germany's cumulative installed capacity will reach 81.8 GW, which is about 38% compared to the target of 215 GW installed capacity by 2030, and an average of 19 GW of new installed capacity must be reached every year. Since Germany's installed capacity performance in recent years has always been in the front class of European countries, coupled with the government's policy of supporting the development of photovoltaic, the analysis of the possibility of reaching the target is high.

In terms of policy, Germany proposed a number of stimulus policies last year to stimulate demand for distributed PV projects, and also allocated a budget of 4.1 billion euros to subsidize the production of local PV raw materials and modules, in an attempt to strengthen the production capacity of the local supply chain. However, the German Constitutional Court ruled in mid-November last year that the federal government had violated the "debt brake" by investing unused debt funds for epidemic prevention in green energy industry program expenditures, resulting in a 60 billion euro budget freeze by the court, and the federal government is therefore facing a fiscal budget gap. In order to resolve the financial impasse, the federal government cut the "Climate and Transformation Fund (KTF)" and the PV subsidy budget, which may affect the PV subsidy expenditures, but also weakened the ability to strengthen the subsidy of local PV production capacity. However, the Federal Cabinet also passed the draft of "PV package (Solarpaket)" in August last year, which will be sent to the German Bundestag and the European Parliament for a vote in February and March this year, and it is currently estimated that in the future, Germany may simplify the PV grid connection procedure, increase PV bids, or provide case land as a stimulus to stimulate the main axis of the policy.

Spanish

Spain's grid company Red Eléctrica statistics, Spain in 2023, a total of about 4.7 GW of new PV installations, as of January this year, Spain's cumulative installations have exceeded 25 GW, compared to 76.4 GW installed in 2030, the target completion of nearly 33%, an average of at least 7.4 GW of new installations each year is expected to meet the target as scheduled.

Spain is less obvious in stimulating the demand for residential PV compared to Germany, and mainly focuses on PV installations in public facilities, increasing PV installations in public facilities through the "Rehabilitation, Transformation and Recovery Program (RTRP)" and subsidizing residential PV installations through the "Next Generation Funds", according to the statistics, the public facilities account for 60% of the total PV installations; the industrial and commercial sectors account for 27%; and the residential PV installations account for 13%. According to statistics, public utilities currently account for 60% of total PV installations, the industrial and commercial sector accounts for 27%, and the residential sector accounts for 13%. However, Spain is a leader in Europe in terms of Power Purchase Agreements (PPAs), which makes it easier to attract developers to invest in the country, and the number of large-scale projects continues to increase, but there are some challenges to be overcome, such as a long time for applying for project permits, low administrative efficiency of the government, and shortage of professional PV technical manpower. However, there are some challenges to be overcome, such as long project permit application times, inefficient government administration and a shortage of specialized PV manpower, as well as protests from local farmers that installing PV on agricultural land may affect agricultural performance and the development of centralized projects. Overall, however, Spain is still one of the most promising markets in Europe, and demand is expected to grow by 28-32% this year compared to last year.

Polish

According to the Polish Energy Regulatory Authority (Institute for Renewable Energy, IRE), a total of about 4.2 GW of new PV installations were added from January to November 2023, and as of November last year, the cumulative installations in Poland were nearly 16.4 GW, which is the highest rate of compliance with the PV installation target in Europe, compared with the target of 27 GW installations in 2030, and the average annual increase of at least 1.6 GW is needed to meet the target. As of last November, Poland had accumulated nearly 16.4 GW of PV installations, compared with the target of 27 GW installations by 2030, it has accomplished 61%, which is the highest PV installation target rate in Europe.

Demand for PV in Poland is growing steadily, driven by the Energy Policy of Poland until 2040 (PEP2040), which has made Poland the country with the highest rate of PV installations in the European region. one of the main reasons for the strong demand for PV in Poland in 2023 is the fifth round of the Mój Prąd program, which was launched last April and successfully stimulated rooftop PV demand. One of the main reasons for the strong demand for PV in Poland in 2023 is the fifth round of the "Mój Prąd" program launched in April last year, which has successfully stimulated the demand for rooftop-type PV. As of the end of September last year, the number of distributed installations of less than 50 kW had exceeded 1.3 million, and about a quarter of the households in the country had installed rooftop-type PV. At present, it is believed that Poland also has great potential in the development of ground-mounted projects, coupled with the commitment to enhance the proportion of green energy in Poland Donald Tusk became prime minister at the end of last year, and if a number of stimulating policies continue to be put forward this year, it is expected to boost the demand for photovoltaic in the Polish market, and it is expected that the demand in Poland this year is expected to grow by about 31% compared with that of last year.

Italy

The increase in distributed PV installations in 2023 is mainly attributed to the "2023 Superbonus", which provides a tax credit of 90% to PV installers. Although this is significantly lower than the 2022 Superbonus of 110%, it has also successfully stimulated the demand for rooftop PV, and according to the statistics, in the first half of last year, about 47% of distributed PV installations in Italy came from distributed projects. According to statistics, in the first half of last year, Italy installed about 47% from distributed projects. However, 2023 Superbonus tax credit will be adjusted down to 70% from this year, observation of Italy imported Chinese PV module information, last year's fourth quarter compared to the first three quarters of pulling goods has been a significant decline in the quarterly average decline of about 60%, showing that the tax rate cuts down really impact distributed project demand. Although the Italian government announced in 2023 to extend "Detrazione 50%" to the end of 2024, to encourage households to install photovoltaic panels and energy storage systems, each household can enjoy a maximum of 50% income tax deduction, but analyze the demand stimulus brought about by less Superbonus significant.

Overall, although it is estimated that Italy should be able to maintain a certain amount of demand this year, but if it is not possible to put forward other stimulating policies, simplify the grid review process and improve the grid transmission, the demand is more difficult to show significant growth, or can be expanded by the development of agricultural power and other large-scale projects to stimulate the demand for photovoltaic. At present, it is estimated that Italy's 2030 installation target is about 36%, with an average of at least 7.3 GW of new installations per year, and there is still considerable demand for PV in the long term, but if we want to accelerate the speed of PV installation, we still need to observe whether the above problems can be improved.

Overview of the first quarter of 2024 to the first half of the European market overview, due to the first quarter by the winter and installed manpower shortage, for the European traditional pulling off-season, the demand may therefore be affected, but the recent European distributors to speed up the speed of component inventory elimination, analysis of the rapid de-inventorization of the inventory will make the European pulling to replenish the warehouse, is expected to a certain extent to support the first quarter of this year's demand in the European market. However, in terms of long-term demand, the average price of electricity in Europe from the high point of 438 euros per MWh in September 2022, fell to 84 euros per MWh in December 2023, a drop of more than 80%, which may affect the degree of end-users on the demand for photovoltaic, resulting in the first half of this year it is difficult to regain the same period last year's demand for heat, coupled with the part of the country and the review of the process of the network with the bureaucracy is still not yet obtained. Significantly improved, making it difficult to install rapid growth, coupled with the base period of the year-on-year increase, the overall growth rate is slowing down. In terms of annual demand, with the traditional peak season of European market in the second and third quarters, and the market demand starting to shift from PERC to TOPCon, the European market is expected to maintain a certain degree of demand, and then with the arrival of the off-season in the fourth quarter, a downward revision of pulling power is likely to occur.

As for the annual demand, with the traditional peak season of European market in the second and third quarters, and the market demand starting to shift from PERC to TOPCon, the European market is expected to maintain a certain degree of demand, and then with the arrival of the off-season in the fourth quarter, the downward revision of pulling power is likely to occur as a normal situation.

Overall, Europe's rapid inventory depletion is expected to maintain a certain amount of demand in the first quarter of this year, but can not reproduce the same period last year's pulling tide; the second half of the year with the battery technology from P to N, the demand is expected to rebound, this year's demand year-on-year last year, there is a chance of growth of at least 15%. Prospect of long-term demand, most European countries want to reach the goal of the installed capacity of 2030, but at present, most of the countries to achieve the target rate is still not more than 40%. 40%, which reflects the urgency of accelerating the speed of installation, coupled with the fact that net-zero has become the energy development goal of most European countries and even the EU, long-term demand is expected to continue to rise.

Source: InfoLink Consulting

Special notice: Goodhao is reproduced from other websites for the purpose of transmitting more information rather than for profit, and at the same time does not mean to endorse its views or confirm its description, the content is for reference only. Copyright belongs to the original author, if there is infringement, please contact us to delete.